401k Max Salary 2025

401k Max Salary 2025. As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. Other limits also apply, including the amount your employer can.

As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. Advantages of 401 (k) accounts:

Maximum Salary Deferral For Workers:

(for 2023, it's $66,000.) if you're 50 years old or older, it's $76,500.

Other Limits Also Apply, Including The Amount Your Employer Can.

For 2025, the contribution limit increases again to $23,000.

The 2025 401 (K) Contribution Limit.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

How Much Can I Contribute To My SelfEmployed 401k Plan?, But if you max out your 401 (k). Employer contributions are also limited to 25% of an employee's salary.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a. $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

What Are the Maximum 401(k) Contribution Limits? GOBankingRates, The total of all employee and employer contributions per employer will increase from $66,000 in 2023. As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical 401k Contribution Limits Employer Profit Sharing Is Significant, Advantages of 401 (k) accounts: For tax year 2025 (filed by april 2025), the limit is $23,000.

Source: sheetsforinvestors.com

Source: sheetsforinvestors.com

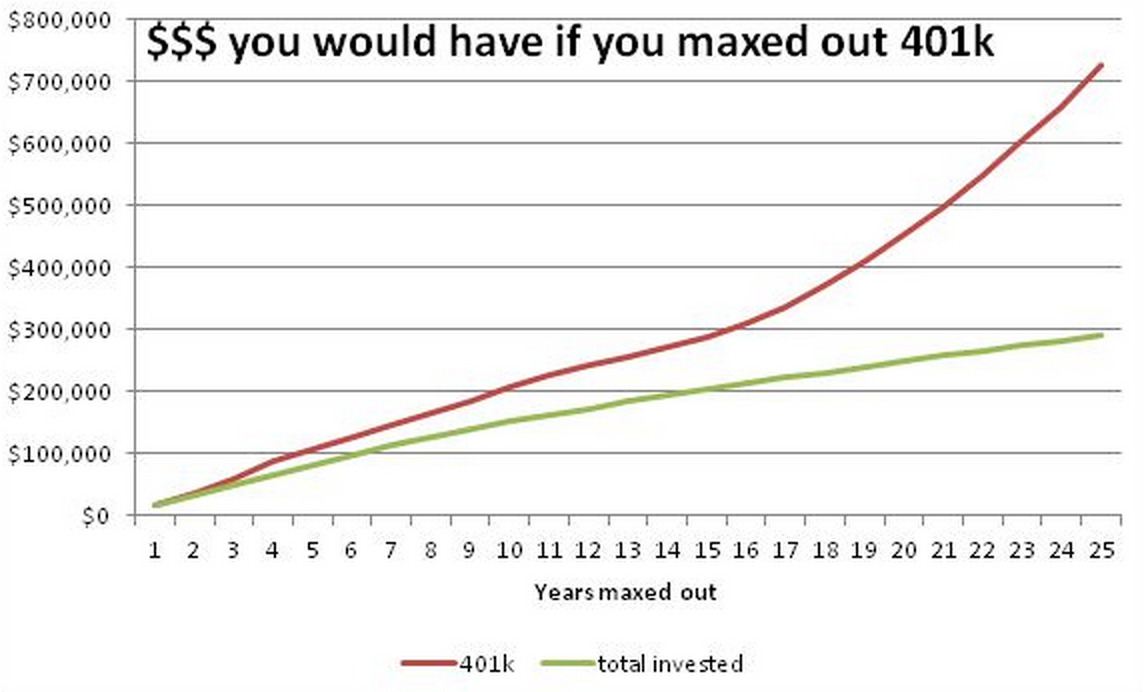

Free 401(k) Calculator Google Sheets and Excel Template, But if you max out your 401 (k). People 50 and over can contribute an extra $7,500 to their 401(k) plan in 2023 and 2025.

Source: www.procalculator.com

Source: www.procalculator.com

401k Calculator Calculators For All Mobile Friendly, Maximum salary deferral for workers: $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

Federal 401k Contribution Limit 2025 Gaby Pansie, The 2025 401 (k) contribution limit. $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Source: corrinewalys.pages.dev

Source: corrinewalys.pages.dev

401k Changes For 2025 Dodi Nadeen, Employer contributions are also limited to 25% of an employee's salary. For 2025, your personal contributions cannot exceed $23,000 or $30,500 if you are age 50 or older.

Source: aubreeqnatasha.pages.dev

Source: aubreeqnatasha.pages.dev

401k Annual Limit 2025 Reeva Celestyn, For 2025, the contribution limit increases again to $23,000. $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Last Day To Contribute To 401k 2025 Katya Melamie, 2025 401 (k)/403 (b)/401 (a) total contribution limit. For 2025, it's $69,000 if you are under 50 years old.

For 2025, The Contribution Limit Increases Again To $23,000.

Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government's thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

The Combined Limit For Employee And Employer Contributions Is $69,000 In 2025, Up From $66,000 In.

(for 2023, it’s $73,500.) and it can’t exceed.